Key Strategies for Successful Forex Trading

Key strategies for successful forex trading are essential for anyone looking to navigate the dynamic and often volatile foreign exchange market. The forex market operates 24/7, offering traders the opportunity to profit from the changing value of global currencies. However, to trade successfully, you need to understand the market’s complexities and employ effective strategies. These strategies can help mitigate risk and improve profitability, especially when followed consistently. Whether you’re a novice or an experienced trader, using key strategies can enhance your trading performance.

1. Understanding Market Trends

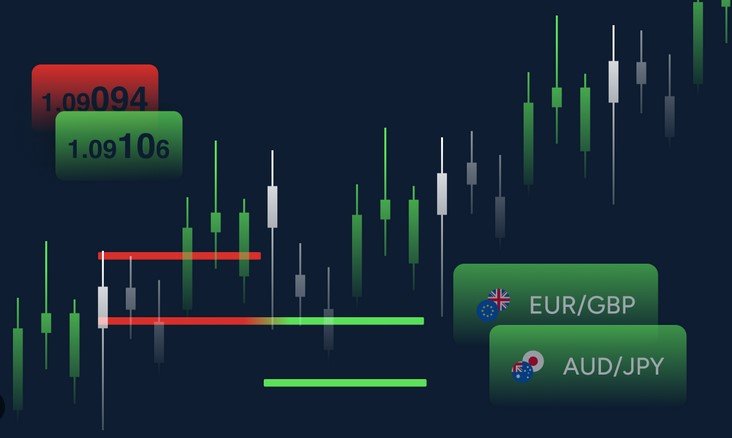

The first of the key strategies for successful forex trading is to understand market trends. Forex markets are influenced by global economic events, political developments, and central bank policies. Traders who keep a close eye on these trends can capitalize on currency movements.

Trend analysis involves studying historical price data to identify patterns that indicate whether a currency is likely to increase or decrease in value. For instance, if a currency has been steadily increasing over time, this could be an indication that it will continue to rise. Technical analysis tools such as moving averages and trend lines can help traders recognize these patterns. By aligning your trades with market trends, you increase the probability of success.

2. Risk Management: Protecting Your Capital

Another critical part of key strategies for successful forex trading is risk management. One of the biggest mistakes that traders make is risking too much of their capital on a single trade. In forex trading, it is essential to protect your capital by limiting the amount you are willing to lose on any given trade. Successful traders always have a clear risk management plan.

One effective way to manage risk is by setting stop-loss orders, which automatically close a trade when the price reaches a predetermined level. This prevents significant losses and protects your investment. Additionally, many traders follow the 1% rule, meaning they never risk more than 1% of their total capital on a single trade. This approach ensures that even if a trade goes wrong, you have enough funds to continue trading and recover losses over time.

3. Leverage and Position Sizing

Leverage plays a significant role in key strategies for successful forex trading. Forex trading allows traders to control large positions with a relatively small amount of capital, thanks to leverage. While leverage can amplify profits, it can also increase losses, so it’s important to use it wisely.

To trade effectively, you must understand how much leverage is appropriate for your risk tolerance and trading strategy. Using too much leverage can lead to significant losses, while using too little can limit your profit potential. Position sizing is another critical element in leveraging effectively. Position sizing refers to determining how much of your capital to allocate to each trade, which directly influences the amount of risk you’re taking on.

4. Developing a Trading Plan

Successful forex traders always have a well-defined trading plan. One of forex trading strategies is to establish a clear plan before entering any trade. A trading plan outlines your goals, risk tolerance, entry and exit points, and overall strategy.

Your trading plan should also include a set of rules that you follow consistently. For example, you might decide to only trade during specific times of the day or only enter trades when certain technical indicators signal an opportunity. Sticking to your plan helps eliminate emotional trading, which often leads to mistakes and losses. Having a disciplined approach to trading is crucial for long-term success.

5. Continuous Learning and Adaptation

Forex markets are constantly evolving, which means successful traders must keep learning and adapting to changes. Continuous education is a cornerstone of the key strategies for successful forex trading. Staying informed about market developments, studying new trading techniques, and learning from both successes and failures are all essential aspects of becoming a better trader.

It’s also important to remain flexible in your approach. Markets can be unpredictable, and what worked yesterday may not work today. Being able to adjust your strategies based on new information or changes in the market environment is vital to staying ahead of the curve. Traders who fail to adapt often find themselves struggling to keep up with market trends.

Navigating the World of Forex Trading

FX-Navi.net provides essential tools and insights for both beginner and experienced forex traders. With expert analysis, market updates, and educational content, the site helps users make informed trading decisions. Staying up to date with market trends is key to success in the FX world. For a change of pace, explore trusted french casinos for a secure and entertaining online experience.

Discover Premium Insights and Entertainment

FX-Navi.net offers in-depth analysis and updates for traders looking to stay ahead in the financial markets. For a blend of leisure and excitement, the jokacasino VIP Room provides an exclusive gaming experience. Combining expert knowledge with premium entertainment options, visitors can enjoy both learning and relaxation. Enhance your online experience with tools and opportunities designed for excellence.

Navigating the Global Forex Market with Precision Tools

Success in Forex trading hinges on having access to reliable, real-time data and sophisticated analytical tools to make informed decisions swiftly. Our platform provides users with essential navigation resources, helping them decode market trends, manage risk, and identify high-potential trading opportunities. Mastering the market requires dedication to learning and continuously refining your strategies based on accurate, up-to-date indicators. Just as traders seek premium tools for an edge, those seeking exclusive online access value a direct, privileged entry point to their desired environment.

Premium Tools and Dedicated User Access

For advanced traders seeking the highest level of detail and responsiveness, having a dedicated, fast-loading interface is non-negotiable. Similarly, patrons seeking an elevated experience and exclusive environment in other online spheres look for their dedicated space, such as the jackpotjillvip VIP Room.

Take a Break and Enjoy Online Fun

At FX Navi, we focus on providing insightful financial news and analysis for our audience. For moments of leisure, Jokacasino Casino Room offers instant access to a variety of engaging games. Whether you’re taking a short break or enjoying a longer session, the platform ensures smooth and entertaining gameplay.

Conclusion

In conclusion, key strategies for successful forex trading include understanding market trends, managing risk effectively, using leverage wisely, developing a robust trading plan, and continuously learning. Forex trading can be profitable, but it requires discipline, patience, and a commitment to following well-defined strategies. By staying focused and consistently applying these strategies, traders can maximize their chances of success in the forex market.