Understanding Ethereum Share Charts: An In-Depth Guide

In the world of forex trading, calculated risks and strategic decisions are the keys to success. Similarly, platforms like crazyvegas no deposit casino bonus codes australia offer users a chance to engage in entertainment without financial risk. Just as traders test strategies with demo accounts, players can explore games without deposits—both avenues allow informed decision-making with minimal exposure.

Ethereum, the second-largest cryptocurrency by market capitalization, plays a crucial role in the decentralized finance ecosystem. Investors and traders closely monitor Ethereum share charts to make informed decisions about buying, selling, or holding their assets. This article delves into the significance of Ethereum share charts, how to interpret them, and the tools available for analysis.

What Are Ethereum Share Charts?

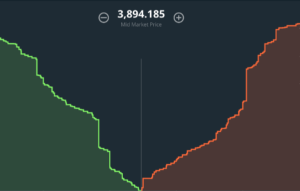

Ethereum share charts, often referred to as Ethereum price charts, display the historical price movements of Ethereum (ETH) over time. These charts help traders and investors visualize trends, identify potential entry and exit points, and make predictions about future price movements. They are essential tools for technical analysis, a method used to evaluate and predict the price movements of assets.

Types of Ethereum Share Charts

Several types of charts are commonly used to analyze Ethereum’s price:

- Line Charts: Line charts are the simplest form of charting. They plot the closing price of Ethereum over a specific period, connecting these points with a continuous line. This type of chart provides a clear view of the overall trend but lacks detail about price volatility.

- Bar Charts: Bar charts offer more detail than line charts. Each bar represents the price range for a specific time period, showing the opening, closing, highest, and lowest prices. This provides a more comprehensive view of price movements and volatility.

- Candlestick Charts: Candlestick charts are popular among traders for their detailed information. Each candlestick represents a time period and includes four key data points: opening price, closing price, highest price, and lowest price. The body of the candlestick shows the range between the opening and closing prices, while the wicks indicate the high and low prices. This type of chart helps identify market trends and potential reversals.

Interpreting Ethereum Share Charts

To effectively use Ethereum share charts, understanding key concepts and indicators is crucial:

- Support and Resistance Levels: Support levels are prices at which Ethereum tends to find buying interest, preventing the price from falling further. Resistance levels are prices where selling interest typically emerges, preventing the price from rising. Identifying these levels helps traders determine potential price targets and stop-loss orders.

- Trend Lines: Trend lines are straight lines drawn on a chart to connect price highs or lows. They help identify the direction of the market (uptrend, downtrend, or sideways). Drawing trend lines accurately can assist in recognizing ongoing trends and potential reversals.

- Moving Averages: Moving averages smooth out price data to identify trends. The two most common types are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). The SMA calculates the average price over a specified period, while the EMA gives more weight to recent prices. Moving averages help traders determine the overall direction of the market and potential buy or sell signals.

- Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is used to identify overbought or oversold conditions. An RSI above 70 indicates overbought conditions, while an RSI below 30 suggests oversold conditions. Traders use RSI to anticipate potential reversals or corrections.

- Volume: Volume represents the number of Ethereum units traded during a specific time period. Analyzing volume alongside price movements can provide insights into the strength of a trend. Increasing volume during an uptrend suggests strong buying interest, while increasing volume during a downtrend indicates strong selling pressure.

Elevate Your Online Strategy with Kingjohnnie VIP Club

At FX-Navi, we provide in-depth analysis, market insights, and guidance for traders looking to sharpen their forex strategies and navigate the digital economy. When you’re taking a break from charts and commentary, the Kingjohnnie VIP Club offers an engaging online entertainment experience that complements your focus with relaxation. Whether you’re winding down after market hours or seeking supplemental digital avenues, Kingjohnnie VIP Club delivers a user-friendly platform with varied options. Discover how it can enhance your tech-savvy journey with FX-Navi.

Tools for Analyzing Ethereum Share Charts

Several tools and platforms are available for analyzing Ethereum share charts:

- TradingView: TradingView is a popular charting platform that offers a wide range of tools and indicators for technical analysis. It features customizable charts, a large community of traders, and social trading features, allowing users to share ideas and strategies.

- Coinigy: Coinigy provides advanced charting tools and integrates with various cryptocurrency exchanges. It offers real-time data, technical indicators, and drawing tools for in-depth analysis.

- CryptoCompare: CryptoCompare offers comprehensive charts and analysis tools for Ethereum and other cryptocurrencies. It provides historical data, technical indicators, and market insights.

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5): MetaTrader platforms are widely used for trading and analyzing financial markets. They offer advanced charting capabilities, technical indicators, and automated trading features.

Tips for Effective Chart Analysis

- Combine Technical and Fundamental Analysis: While technical analysis focuses on price and volume, combining it with fundamental analysis (such as news, events, and developments related to Ethereum) can provide a more comprehensive view of the market.

- Practice Risk Management: Always use stop-loss orders and position sizing to manage risk. Technical analysis helps identify potential entry and exit points, but it is essential to protect your investments.

- Stay Updated: Cryptocurrency markets are highly volatile and influenced by various factors. Stay informed about market news, developments, and trends to make better trading decisions.

- Practice Regularly: The more you practice analyzing Ethereum share charts, the more proficient you will become. Use demo accounts or paper trading to refine your skills before committing real funds.

Strategic Leisure: Discovering Platforms Like Casino Corner

Just as traders seek platforms that offer clarity and value, entertainment seekers often look for hubs that deliver reliability and excitement. One such example is casino corner, a curated site for those interested in Canadian online casinos. Like forex trading platforms, it provides users with valuable information to help make better choices—only in the world of online gaming.

Conclusion

Ethereum share charts are invaluable tools for traders and investors looking to navigate the cryptocurrency market. Understanding different types of charts, key indicators, and analysis tools can significantly enhance your ability to make informed decisions. By combining technical analysis with fundamental insights and practicing effective risk management, you can better navigate the dynamic world of Ethereum trading. Stay vigilant, keep learning, and adapt to the ever-changing market conditions.

As we explore advanced charting techniques for Ethereum analysis, it’s worth noting how different platforms handle data visualization. While crypto charts track price movements and trading volumes, other sectors like iGaming employ similar tracking mechanisms for user engagement metrics.

For instance, platforms requiring secure access such as Jokaviproom Casino Room Login utilize dashboard analytics that share conceptual similarities with trading interfaces. Understanding these parallel systems can enhance your overall technical analysis skills across different financial and digital environments.

Mastering Ethereum share charts involves recognizing patterns that often transcend specific market verticals, making cross-industry knowledge valuable for comprehensive market understanding.

111 comments